First of all, why hasn’t Harry written a blog since the end of August?

a) Third Year is difficult

b) Third Year is difficult

c) I’m lazy

d) Third Year is difficult

Good, glad that’s dealt with. Moving on…

Dreary afternoons in the library spent weeping over my dissertation has led me to wonder what else I could be doing with my £9000 a year. So, I did a little research, and found some pretty interesting alternatives. Here are my top 5:

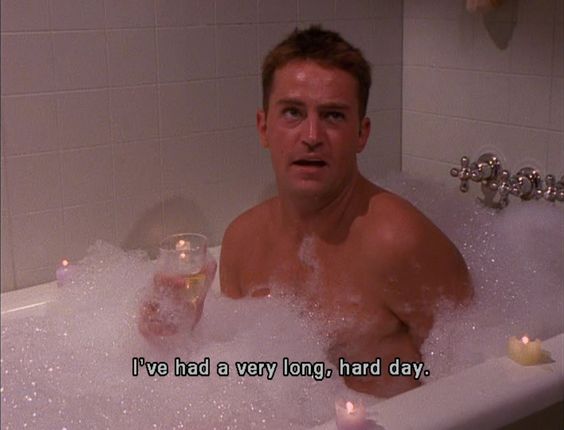

You could take 26 baths a day or flush 450,000 toilets*

It costs £700.80 to bath twice a day for a whole year. Not feeling like a degree? Then you could run 25.68 baths a day instead. Or instead flush it (literally) down the toilet…450,000 times.

*I didn’t say this list would be useful.

Buy a really expensive drink

A bar in London is selling a cocktail, called the ‘Gigi’ for £8,888. Screw 9am lectures, you could have a combination of vintage champagne and an ultra-rare Armagnac brandy that pre-dates the Boer War.

A waterproof pool table

Ever been swimming, and thought, “this water is really missing the facility to be able play pool”? Well you could use your well-borrowed money to buy a waterproof pool table, solving a problem you never knew you had.

Buy a massive gumball machine

Ever wanted a bubble gum machine that was as tall as you? Me neither. But for your tuition fees you could have 3! Money well spent I say.

A Gold Lego Brick

No Lego set is complete without a 14K solid gold Lego brick. For $14,499.99 you could have one. Now I know this is more than a years worth of loan but you got to save up for some things.

Bet that degree seems wasted now…

Recent Comments